Save school supply receipts for possible tax savings

| Rhonda Silence-

Fri, 08/23/2019 - 4:07pm

Tweet

Parents around the State of Minnesota are in the midst of shopping for school supplies. The Minnesota Department of Revenue reminds those parents that most school supply purchases qualify for valuable K-12 tax benefits on your 2019 Minnesota income tax return.

Minnesota Revenue Commissioner Cynthia Bauerly notes that every year, parents across Minnesota invest in their children's education by purchasing school supplies. Bauerly says parents should keep receipts for these purchases and claim the K-12 Education Credit or Subtraction to help save money when it comes time to their file Minnesota income tax return.

There are two methods to obtain those credits, the K-12 Education credit and the K-12 Education Subtraction. Either method could reduce your state tax and help you receive a larger income tax return. Last year, more than 33,000 families received the K-12 Education Credit and saved an average of $244. Over 178,000 families received the K-12 Education Subtraction.

To obtain the credit, parents simply need to fill out one tax form and include it with their regular tax filing.

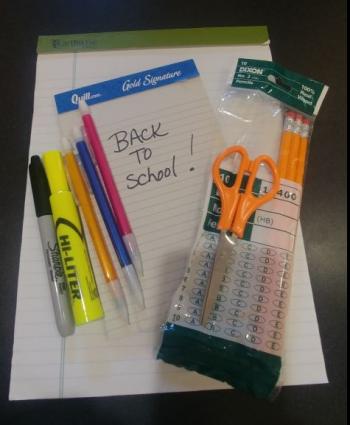

Most expenses for educational instruction or materials qualify, including:

* Paper

* Pens and notebooks

* Textbooks

* Rental or purchases of educational equipment, including musical instruments

* Computer hardware and educational software (up to $200 for the subtraction and credit)

* After-school tutoring and educational summer camps taught by a qualified instructor

WTIP spoke with local tax preparation volunteer Steve Deschene to find out more about this program.

For more help from a local volunteer tax volunteer, call the Cook County Community Center at 218-387-3015.

Listen:

Program:

Tweet